Business email compromise (BEC) scammers are now targeting a company’s customers using a new indirect attack method designed to collect information on future scam targets by asking for aging reports from collections personnel.

Aging reports, also known as a schedule of accounts receivable, are sets of outstanding invoices which allow a company’s financial department to keep track of customers who haven’t yet paid services or goods they were allowed to buy on credit.

“It’s an essential tool for both accounts and management to maintain an overview of their credit and collection processes, and breaks down outstanding debts into thirty-day increments, culminating with payments that are more than ninety days overdue,” says Agari threat researcher James Linton.

BEC (also known as Email Account Compromise – EAC) fraud schemes are scams through which crooks trick organizations’ employees into wiring money to entities they trust but whose bank accounts were swapped with ones controlled by the crooks.

The new BEC fraud scheme

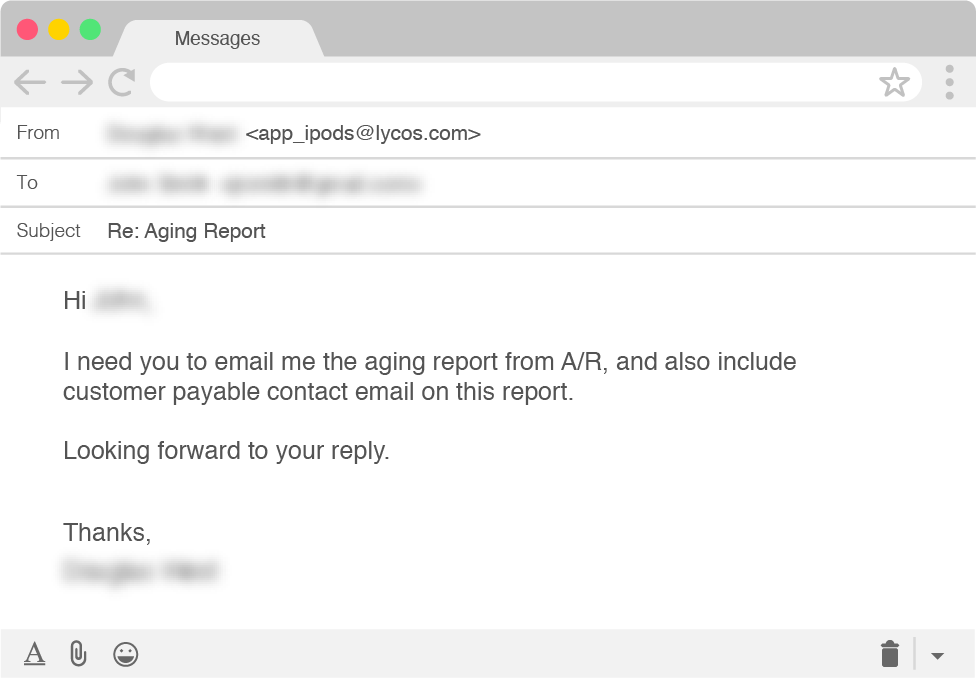

The attackers have been intercepted by Agari Cyber Intelligence Division (ACID) while posing as CEOs of targeted companies and requesting information from employees on invoices that are overdue for payment in the form of an aging report.

Name deception and free email accounts were used by the crooks in their attempt to deceive company employees to follow up to their demand for company records.

Not asking for payments straight out is exactly what makes this new BEC attack so unusual seeing that, in most other similar scams, financial department employees are asked to send payments to attacker-controlled bank accounts.

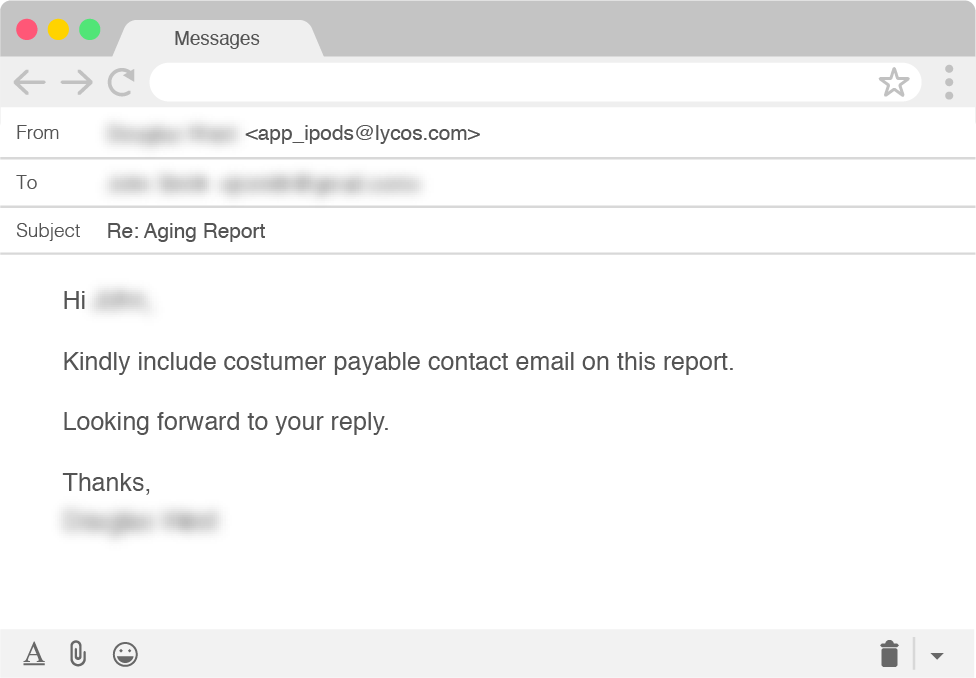

ACID responded to the scammers by sending in a fake aging report which prompted the cybercriminals to ask for a list of customers coupled with any debts they might have to extinguish. To have all the info at hand, the crooks also requested to be sent the clients’ email addresses.

“Armed with this intelligence—customer names, their outstanding balances, and contact information—the scammers’ next targets would be our fake company’s customers,” says Agari.

“With this information, they can create a credible-looking email account alias, assume the identity of an employee on our finance team, and request that they pay the outstanding balance referenced on the aging report.”

To make sure that their targets would fall for their scam, the attackers will most likely also offer them a “good deal” such as having to pay less to have their debts settled, immediately followed by a quick swap of the banking account with the one the scammers use for collecting their bounty.

The fact that scammers have now switched their targets from companies to their customers makes their attacks a lot more dangerous seeing that training employees to detect BEC attempts will no longer be enough to stop the attackers.

Moreover, this new type of scam leads to established payment communication channels being contaminated, with employees and customers no longer trusting them

This will require “proactively contacting all exposed customers to alert them to the possible threat,” as well as having all possible targeted employees aware of this type of threat as measures designed to block BEC attacks.

BEC scams were the cybercrime with the highest reported total losses during 2018, with victims losing over $1,2 billion according to FBI’s Internet Crime Complaint Center (IC3) Internet Crime report published in April.

“Through the years, the scam has seen personal emails compromised, vendor emails compromised, spoofed lawyer email accounts, requests for W-2 information, and the targeting of the real estate sector,” IC3 explains in the report.

BEC attacks have also seen an explosive 476% growth between Q4 2017 and Q4 2018, with the total number of email fraud attempts against organizations increasing by 226% QoQ as detailed in a Proofpoint report from January.

Related Articles:

BEC Scams Average $301 Million Per Month In Illegal Transfers

Over $800,000 Stolen by Scammers in Atlanta Area City BEC Fraud

Man Gets 51 Months in Prison for $10M BEC Fraud, Romance Scam

Scattered Canary Evolves From One-Man Operation to BEC Giant

Twitter Can be Tricked Into Showing Misleading Embedded Links

Bleeping Computer® is a community of individuals of all ages who are here to learn new information, to help each other, and to help their fellow peers. With that in mind, we ask that all members please follow these simple rules in order to create an atmosphere where everyone feels comfortable.

The rules are as follows:

- All information and instructions given within these forums is to be used at your own risk. By following or using any of this information you give up the right to hold BleepingComputer.com liable for any damages.

- All the forums are categorized by topics. Please post your questions or messages in the appropriate forum.

- Answers to many of the questions you may have can be found in the Tutorials Section, Glossary, or from other posts on the message boards. Please use the search functions, at the top right of each page, to find your answers. If you are still having problems, feel free to post your question.

- All help must be provided in the forums or on our Discord Server. We do not allow support to be provided or requested via personal message, email, or remote desktop control programs (Logmein, TeamViewer, etc).

- If a topic is posted in a forum that is not appropriate for the question, the staff has the right to move that topic to another better suited forum.

- The posting of any copyrighted material on our web site is strictly prohibited.

- Posting links in order to generate affiliate commissions is not permitted at BleepingComputer.com. Any posts that are deemed to be posted in order to generate affiliate commissions, regardless of the product being promoted, will be deleted. If a user continues to create affiliate SPAM posts, they will be banned.

- Posting links to non-Bleeping Computer malware removal guides is NOT permitted with the exception of security vendors who sometimes release specialized tools and instructional documentation. This is because it is impractical for BleepingComputer to monitor and review all such guides for accuracy, no matter how accurate those guides may, in fact, be.

- There will be no use of profanity on our message boards. This will not be tolerated and can lead to immediate suspension.

- When posting, please use proper grammar. Refrain from ‘text-message’ style substitutions of words like ‘u’ for ‘you’, and ‘ur’ for ‘your’. This is a multi-national forum, and some of our non-english speaking members must use translation software which is confused by abbreviations. Most of our volunteer members are very busy helping as many people as they can, and a post that is hard to read will often be overlooked.

- There will be no racial, ethnic, gender based insults or any other personal discriminations. This will not be tolerated and can lead to immediate suspension.

- There will be no posts meant to offend or hurt any other member, in a manner which is offensive or inflammatory. This includes flaming or instigating arguments.

- Spamming is not permitted; please keep all your posts as constructive as possible.

- Pornography, warez, or any other illegal transactions may NOT be linked in any shape or form.

- If you have questions regarding homework, we will only help you with general concepts. If you are looking for a complete solution or answer, we will most likely just delete your post.

- No subject matter will be allowed whose purpose is to defeat existing copyright or security measures. If a user persists and/or the activity is obviously illegal the staff reserves the right to remove such content and/or ban the user. This would also mean encouraging the use or continued use of pirated software is not permitted, and subject to the same consequences.

- If you are receiving assistance in the Virus Removal forum, you are not allowed to request assistance for the same computer at another malware removal forum. This is to prevent conflicting advice from causing issues with your computer or making it unbootable.

- This forum has the right to request alteration or deletion of any offensive post. If this is not done in a prompt manner, the Staff will delete the material themselves.

- Posts may be deleted for any reasons the forum administrators deem reasonable.

- Pictures may be posted as long as they are not explicit, offensive, or copyrighted.

- Advertisements, of any sort, are not permitted. This includes member names and links to commercial sites in Signatures, or in posts. You also may not solicit sales for Newegg through the use of promotion or coupon codes. If you would like to advertise on our site, contact us here.

- In order to reduce spam on the site, you will not be able to add a signature to your account until you reach 25 posts. Signatures are limited to 5 lines or 2000 characters; whichever comes first. If your signature is larger than the allotted size given or deemed unacceptable, you will be requested to adjust your signature. Failure to comply will result in the removal of your signature.

- Only one image per signature. Images in signatures must also be no larger than 500 pixels wide X 90 pixels high. If you have more than one image you will be requested to remove one. If this is not done in a timely manner the staff has the right to modify your signature to abide by these rules.

- Any links in signatures or profiles cannot be commercial in nature or they will be removed by BleepingComputer. You may not put links in your signature soliciting donations unless you are in certain member groups. Those member groups that are allowed will be expressly notified. If you have a personal website or off-site help resource, that is more than fine, but you can not sell products or services through your signature. Multiple links to the same site, unless for a very specific reason, are not permitted in a signature and will be removed.

- Avatars must be in good taste. This means no vulgar or violent images, pornography, or profanity. Avatars that are found to be inappropriate will be removed at the discretion of the staff.

- Linking to hate, anti-Semitic, racist, pornography, warez, or other illegal sites is not permitted.

- Links in your signature must be unobtrusive and can not use formatting so that attention is brought to them.

- Member’s display names can not be email addresses. This rule is in place to protect you from spam bots who will pick up your email address and spam you.

- Members may have only one account on this forum. There is no need to have more than one.

- Any impersonation of a user from these forums, in any mode of communication, is strictly prohibited and will result in a banning.

- Linked and locked topics are pruned regularly to reduce page clutter. If you have a question about where your topic went, please PM a Moderator or Administrator before starting a new topic asking where it went, or posting a duplicate of the original topic. We will be happy to provide you with a link to the new location, or a reason why it was locked and/or removed.

Violation of any of these rules can lead to a banning of the user from our Web Site and a deletion of their account. The consequences will be determined by the Staff on a case by case basis.

When posting you agree that the administrators and the moderators of this forum have the right to modify, delete, edit or close any topic, signature, account, or profile data at any time that they see fit. If you have any questions concerning this, please do not start a new thread, but rather private message to an administrator or moderator.